Growth on Hold? Questioning the Logic of Prolonged Stabilisation

Balancing short-term macroeconomic control with the long-term need for structural investment

School of Economics, Quaid-i-Azam University, Islamabad

2025-07-11

The Central Question

“Stabilization without growth is treating symptoms while the disease progresses.”

Three Critical Questions

What is Pakistan stabilising from?

Twin deficits, debt stress, inflation spiral

Who bears the cost of prolonged stabilisation?

Youth, SMEs, informal workers, provinces

Can we afford to delay growth?

Lost decade vs. managed transition

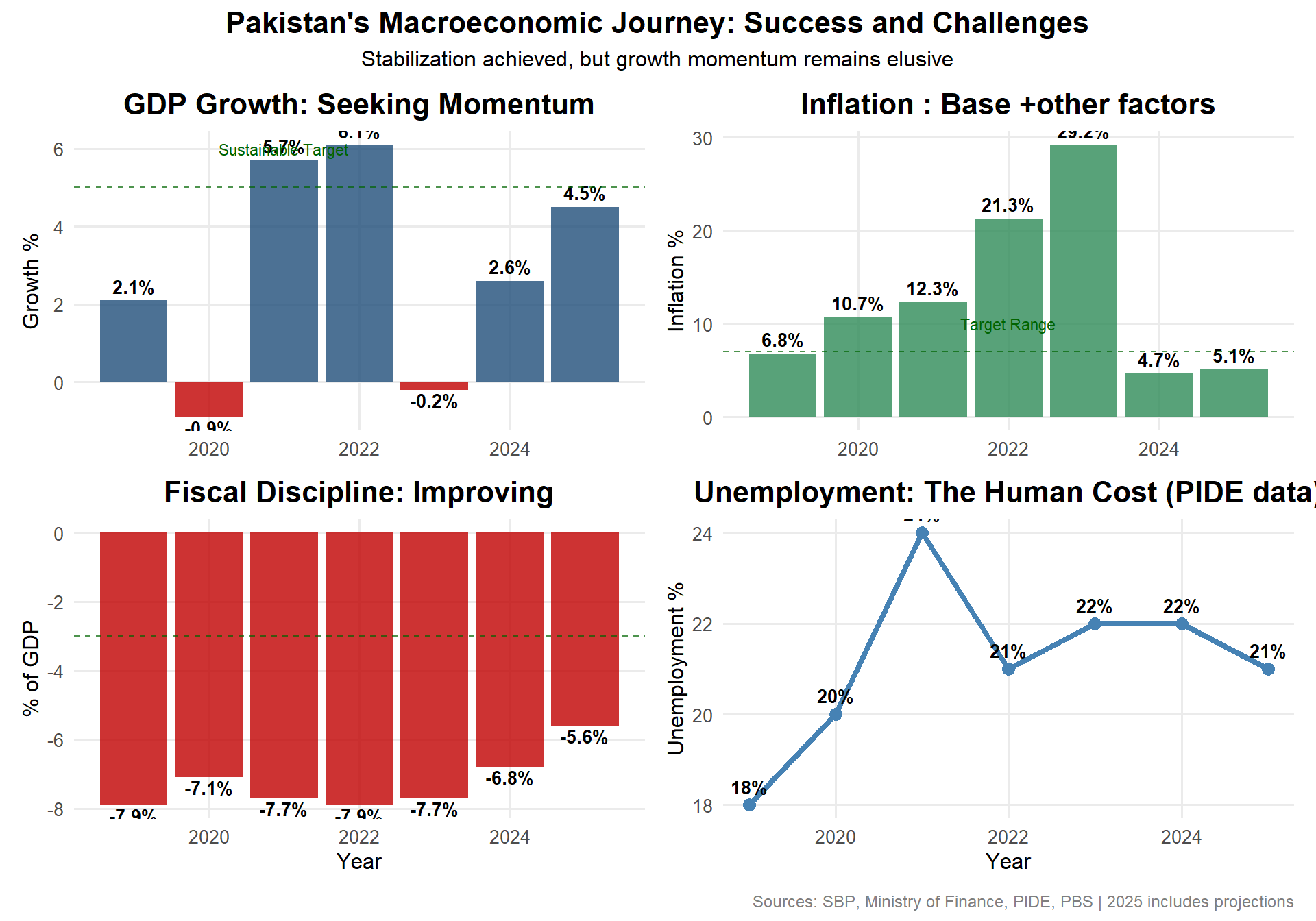

Pakistan’s Economic Transformation: The Numbers Tell a Story

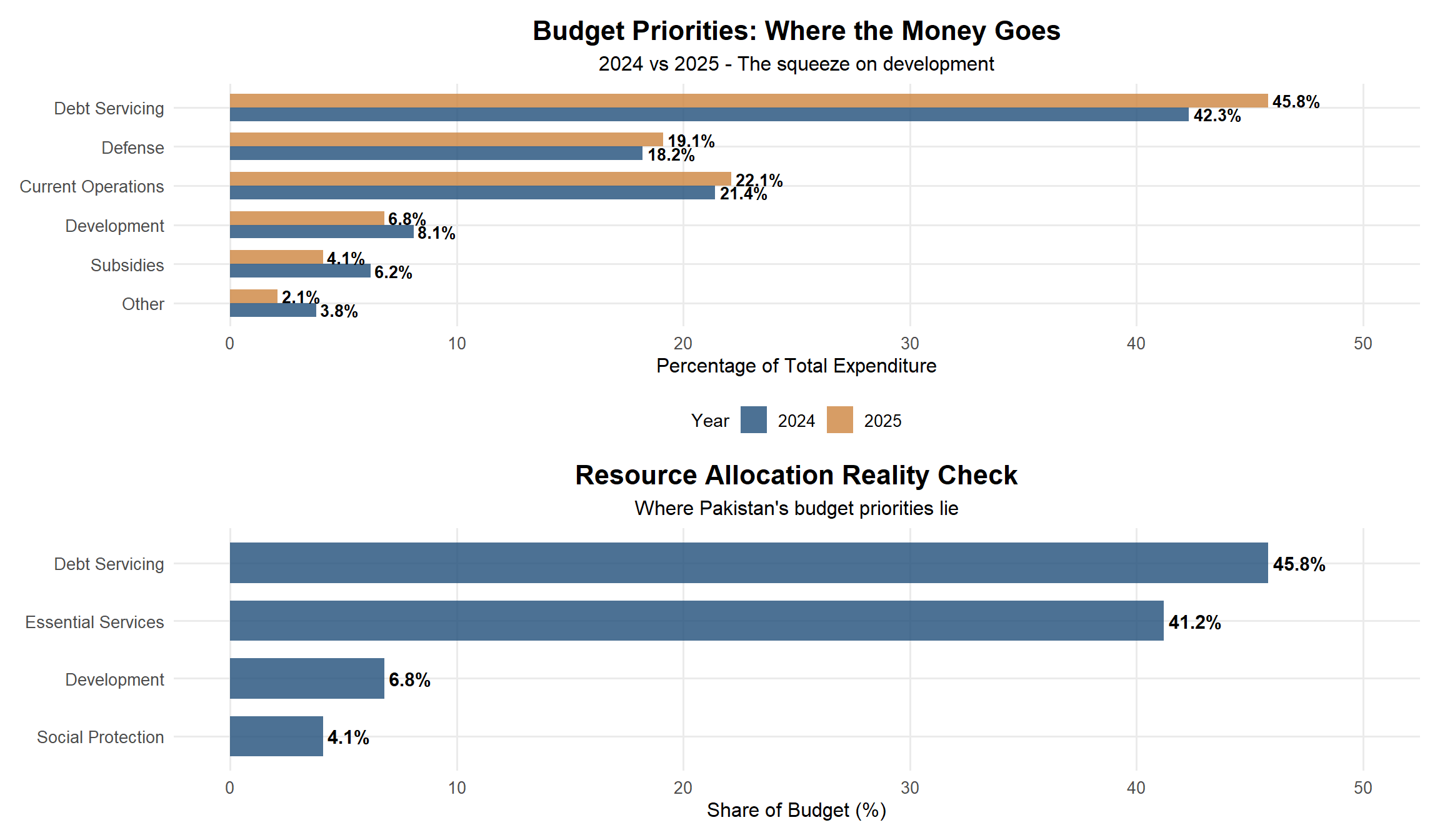

Budget 2025: Stabilization at What Cost?

The Budget’s Message

- What it emphasizes: IMF targets, fiscal discipline, debt management

- What it marginalizes: Development investment, job creation, productivity enhancement

- What it reveals: A budget for survival, not transformation

Kenneth Rogoff on Pakistan Debt Crisis

Pakistan’s Unique IMF Relationship

- Never been out of an IMF program in 75 years

- Currently on the 25th IMF program since independence

- Only country that has never made independent economic policy

The Geopolitical Reality

Kenneth Rogoff: “Pakistan is geopolitically very important… If you don’t sign off on bailout number 25, they’re going to default on bailout number 24”

Tax System & FBR Crisis

FBR

- Single-handedly shrunk formal sector over 15-20 years

- SUPER tax: Don’t grow

- Excessive discretionary powers scaring genuine investors

- Boosted informal economy which doesn’t contribute to productivity, revenues, or FDI

Tax Policy Contradictions

- Corporate tax rates too high (should be halved)

- Agriculture, Services, and Real Estate sectors under-taxed while all burden shared by Industrial sector and formal sector

- NFC distribution issues

- Last 3 years: collected more taxes than previous 14 years combined

The Primary Surplus Trap: When Math Meets Reality

Pakistan’s Debt Sustainability Crisis

The Numbers Don’t Add Up

- Real GDP Growth: 3%

- Real Interest Rate: 7%

- Required Primary Surplus: 2.3% of GDP annually

- Gap to Bridge: 4% per year through austerity

What is Primary Surplus?

Note

Primary Surplus = Government Revenue - Government Spending

(excluding debt service payments)

The money left over before paying interest on existing debt

Key Insight: When real interest rates (7%) exceed growth rates (3%), debt-to-GDP ratio deteriorates by 4% annually unless offset by fiscal surplus

The Mathematical Trap

Key Points:

- The Greece Model: Mandated primary surpluses until 2060 - same framework applied to Pakistan

- Policy Contradiction: Using growth-killing measures to solve a growth-dependent problem

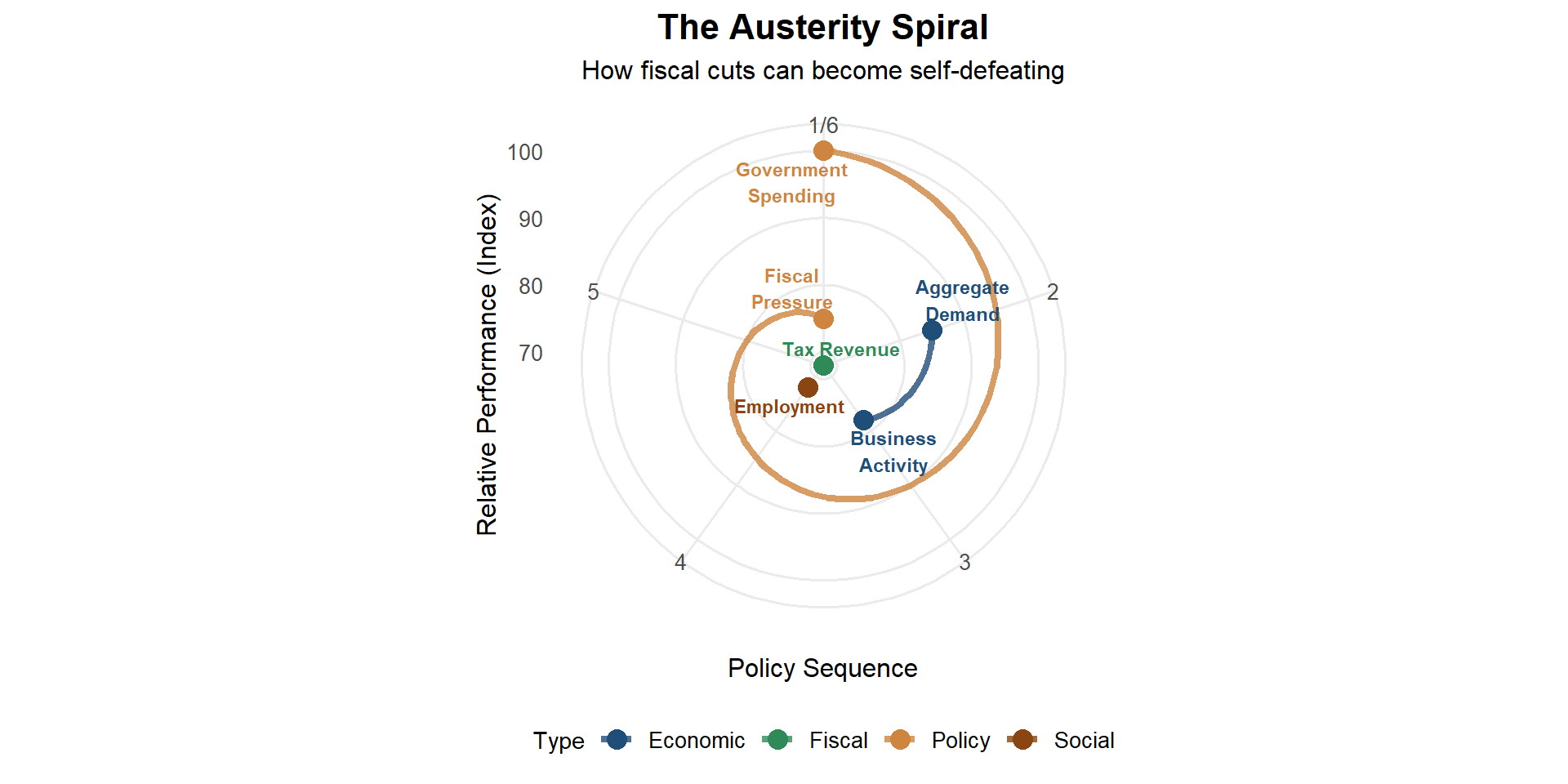

The Krugman Insight: When Austerity Becomes a Trap

“Austerity in a depression is a trap — the more you cut, the weaker your economy becomes.” — Paul Krugman

The Austerity Paradox Applied to Pakistan

Traditional Logic:

Post-Budget Economic Analysis | School of Economics, QAU, Islamabad